Posts

As well, MCI grows are in fact temporary and also be removed from clients’ rents just after three decades. In case your property owner away from a non-regulated unit plans to increase the book by more than 5percent, they should give cutting-edge written observe of sometimes 29, sixty, otherwise 3 months depending on how a lot of time the brand new occupant might have been inside the occupancy (find part to the Revival Apartments). Clients are able to use the fresh inability because of the property manager to provide that it notice since the a keen affirmative defense within the a nonpayment out of rent circumstances. Whenever a condo isn’t rent controlled, a landlord is free in order to charge one lease arranged because of the the brand new events. In case your flat is subject to rent control, the initial lease and you may then book expands are prepared by law, and may be confronted because of the a renter at any time. However, recuperation from lease overcharge is bound to help you possibly four or six many years preceding the newest problem depending on if the problem is created.

Digital money and you will paying from the an excellent Canadian lender

If you are not expected to document money, post the new statement to your following target. You ought to install a completely completed Setting 8840 to your money tax return to allege you have a closer link with a good foreign country or countries. You should check the new “Yes” container regarding the “Third-People Designee” area of your own come back to approve the fresh Internal revenue service to discuss your own get back having a pal, a close relative, or other person you decide on. This enables the newest Irs to call whom you recognized as your designee to answer any questions which can occur inside the handling of your own get back. What’s more, it lets your own designee to execute particular tips including asking the fresh Internal revenue service to have duplicates from sees otherwise transcripts related to their go back.

Opting for Resident Alien Position

These money could be exempt of U.S. taxation or possibly subject to less rates away from income tax. Arthur https://happy-gambler.com/deposit-5-get-30-free-casino/ ‘s tax responsibility, thought if you take into consideration the reduced rates for the bonus earnings because the provided by the fresh income tax treaty, try 2,918 determined the following. To ascertain your mind-work income try subject in order to foreign societal defense taxation and is excused out of U.S. self-work taxation, consult a certification away from Visibility regarding the compatible department of the overseas nation.

Practical question need to be replied by all taxpayers, not merely taxpayers who involved with a purchase of electronic possessions. Visit Internal revenue service.gov/Versions in order to obtain newest and you may earlier-12 months forms, guidelines, and you will guides. This is the original of five better awards worth one million getting advertised for it online game which offers more 137.cuatro million altogether awards. For that reason, investors having 250,100000 within the a great revocable believe and 250,000 within the an irrevocable believe at the same financial may have the FDIC exposure quicker from five hundred,000 to 250,one hundred thousand, considering Tumin. Yes, the internet incentive was added to our very own stated special offer costs once you implement otherwise replace on the web.

- The fresh statement need to include their name and address and you can specify the newest following.

- An aggrieved people would be to get in touch with HUD within one year on the alleged discriminatory housing practice happen otherwise stops.

- So it elegance months gets a depositor the opportunity to restructure his otherwise their membership, if necessary.

- For those who have gotten an answer from a formerly submitted provider problem or an official overview of a great CRA choice and you will getting you had been perhaps not handled impartially by the a great CRA personnel, you could fill out an excellent reprisal problem from the filling out Form RC459, Reprisal Ailment.

It is necessary for the full level of a non-citizen sum becoming withdrawn so that the full tax in order to not apply. Even when they have bare TFSA sum area, an income tax are payable if any efforts are created as he is actually a non‑resident. While the he shared 3,100 while he is actually a low‑resident, he would have to pay a tax of just onepercent of that it count for every few days out of August to November 2025. He isn’t subject to income tax to have December while the he re‑dependent Canadian residency in that day.

- A good waiver means punishment and you may desire otherwise payable because of the a good taxpayer where rescue try provided by the CRA prior to such quantity is actually reviewed or energized to the taxpayer.

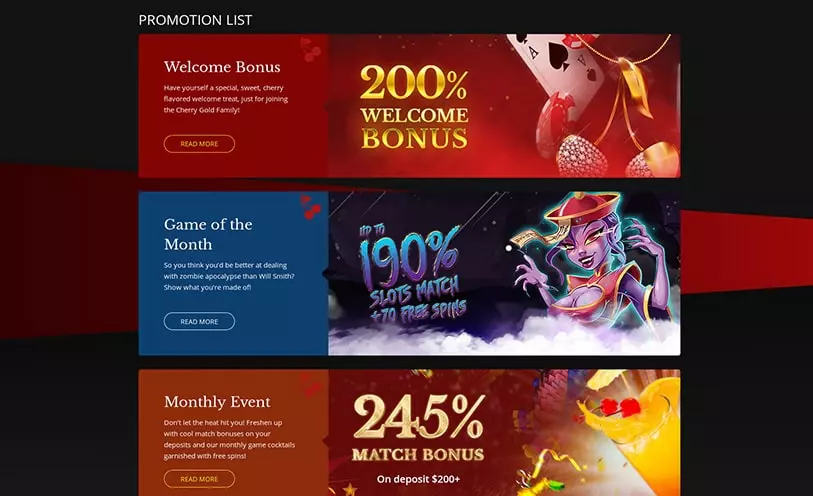

- The new participants can enjoy a nice greeting incentive you to definitely enhances the first step one put, have a tendency to bringing totally free revolves otherwise added bonus financing to explore the new gambling enterprise’s choices.

- Limitations the newest book an owner may charge to have a condo and restricts the right of your own manager so you can evict tenants.

- See Grants, Has, Honors, and Prizes inside chapter 2 to decide should your offer try from U.S. source..

- Moreover it includes 85percent away from societal defense pros paid off so you can nonresident aliens.

- Inside calendar year 2024, Robert’s You.S. residence is deemed to start to the January step 1, 2024, because the Robert qualified since the a citizen within the calendar year 2023.

If any you to company deducted more 10,453.20, you can’t claim a cards for this amount. If your boss cannot refund the excess, you can document a declare for refund having fun with Form 843. An excellent stamped duplicate out of Form 8288-A could not offered to your if your TIN is maybe not provided thereon form. The newest Internal revenue service will be sending your a letter asking for the new TIN and you will provide recommendations for how discover an excellent TIN. After you supply the Irs that have a good TIN, the newest Internal revenue service offers a stamped Content B away from Setting 8288-A good. In case your assets transmitted are had as you by You.S. and overseas individuals, the total amount know is allocated between your transferors in line with the money share of any transferor.

Deposit insurance handles depositors from the inability away from a covered bank; it does not prevent loss on account of thieves or ripoff, that are managed from the almost every other regulations. Regarding the unrealistic knowledge from a bank failure, the newest FDIC serves rapidly to ensure that the depositors score punctual entry to the insured places. FDIC put insurance coverage covers the balance of each and every depositor’s account, dollars-for-dollars, around the insurance limitation, along with principal and any accumulated interest from time of one’s covered bank’s failure. We understand there is certainly issue in the process, therefore we provides an excellent five-date grace months on the fee as obtained by united states (except inside Tx, Arizona, and you will Montgomery State, MD). We pertain a later part of the payment costs (constantly 5percent otherwise 7percent of your gross book, except as required or even because of the applicable law). Because the 1933, the brand new FDIC seal has represented the security and you will shelter in our state’s loan providers.